Written by Stephen Day

Gas Safe Engineer

Updated: 3rd February, 2026

Buying a boiler on finance can be hard with all the different options available. Let us explain all this in plain English for you.

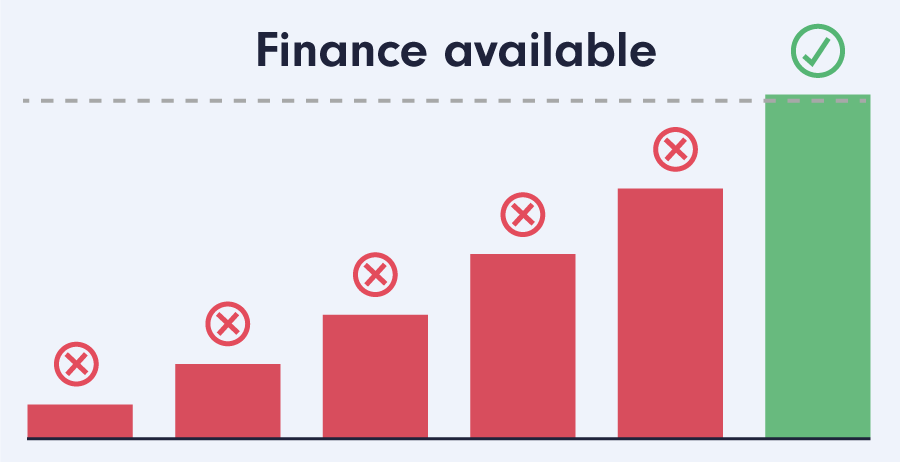

There's no need to pay the full cost of your new boiler upfront; you can spread the cost of your new boiler. Pay in affordable monthly instalments.

How consumers carry out purchases has changed a lot over the past few decades, with people buying clothes, cars, technology and houses on finance plans.

Get a quote in 60 seconds, fitted as fast as next day!

0% APR finance available.

At iHeat we know and understand that a boiler not working can come at the most inconvenient of times, and not everyone can fork out the money to purchase a new boiler right away.

(All figures are intended as a guide only)

In fact, according to a recent survey by Which?, 33% of UK households can’t afford to cover the cost of a new boiler.

We believe that no matter your financial circumstances, you shouldn’t have to come home to a cold house, particularly in the winter months, so we offer a range of finance options to suit you.

According to The Energy Saving Trust, the average boiler replacement costs £2,300 but can cost anywhere between £1,500 and £3,500+, depending on the boiler and the job's complexity.

Unfortunately, the average amount of money households have set aside for repairs and replacements is just £765.

The cost is spread out by paying for a boiler on finance, making it more affordable monthly instead of paying for it all at once.

Purchasing through finance also allows you to pick from a range of boilers instead of settling for the cheapest option due to limited savings.

When purchasing a new boiler through finance, you take all the same initial steps as you would if you were paying directly. The only difference being you need to complete a finance application at the end of your order simple.

Answer a few questions in our interactive form about your home, including your current boiler type, number of bathrooms etc… to allow us to work out which boilers are more suited to your home.

Choose from our range of recommended boilers

Use the finance calculator to select your preferred deposit, loan term and APR and get a fixed quote.

You can either go straight to checkout with your quote or save it for later. Once you’re ready to go ahead with your installation, select an install date and enter your details.

Apply for finance through our website.

You can get a new boiler and installation with iHeat from just £93.54 a month for two years with no deposit and 0% APR.

You can get a new boiler and installation with iHeat for ten years with a 0% deposit and 1139% APR.

Get a quote in 60 seconds, fitted as fast as next day!

0% APR finance available.

These are just a few examples of how you can pay through finance. Get a quote for a new boiler and installation today, and use our calculator to work out which finance package is most suitable for you.

Our website has finance calculators that give you accurate monthly payments based on your finance package, terms and deposit amount.

Deposit amounts are between 0-50%, though the amount you repay depends on which boiler model you have chosen.

Your monthly payments will depend on your boiler finance plan, including the length of term finance you select, your choice of boiler and the deposit you decide on.

To plan your finance, click here.

All finance applications are subject to approval and a credit check. If you think your credit score may be less than fair, we recommend checking your credit on a free site like Experian.

Register to vote

Pay your bills on time

Pay off existing debts

Don’t borrow more than you can afford to pay back

Avoid high-interest loans

See if you are linked to someone else

Check your file for any mistakes

Check your file for fraudulent activity

Utilise less of your credit

Don’t apply for credit through multiple lenders at once

The Affordable Warmth Obligation in 2025 remains a cornerstone of the UK Government's strategy to enhance energy efficiency and support disadvantaged households as part of the Energy Company Obligation scheme.

In 2025, the objective of the Affordable Warmth Obligation is to mitigate fuel poverty by providing essential improvements to make homes more energy-efficient. This effort is a component of the broader Energy Company Obligation (ECO4), a collaborative initiative between the government and major UK energy suppliers. The scheme emphasizes providing services like the free boiler scheme and boiler upgrade scheme, aimed at replacing old, inefficient heating systems with more eco-friendly and efficient alternatives.

Eligibility for the Affordable Warmth Obligation is determined by a combination of income, benefits received, and property type. Specifically, individuals may qualify if they:

Are recipients of certain state benefits, such as Universal Credit, Pension Credit, or Income Support.

Own their home or rent privately (tenant applications require landlord permission).

Possess an inefficient, faulty, or outdated boiler.

Applicants must provide proof of benefit receipt and property ownership to confirm eligibility.

To apply for the Affordable Warmth Obligation, applicants must:

Verify they meet the eligibility criteria.

Gather necessary documents to demonstrate eligibility.

Reach out to an energy supplier participating in the ECO4 scheme.

The energy supplier will guide applicants through the application process and organise a survey if the initial review is positive. They will also detail the steps and documentation needed for a successful application. Local councils or energy-efficiency advisory services may offer additional support.

The Energy Companies Obligation for 2025 plays a vital role in improving energy efficiency and aiding vulnerable households in the UK.

The ECO scheme, now in its fourth iteration (ECO4), operates in partnership between the government and the UK's largest energy suppliers to help upgrade heating systems for those in need. Since its inception, each phase of ECO has introduced improvements and extensions, with ECO4 set to continue until 2028, focusing on sustainability and the reduction of fuel poverty.

Eligibility for the ECO scheme depends on several factors:

Homeownership or residence in social housing.

Receipt of qualifying benefits indicating low income or fuel poverty.

The property must have an Energy Performance Certificate highlighting a need for energy efficiency improvement.

The scheme targets homes with inefficient boilers, though meeting the guidelines does not guarantee acceptance into the program.

To apply for a boiler grant under ECO4, follow these steps:

Confirm Eligibility: Match your situation with the ECO scheme criteria.

Collect Required Documents: Including proof of occupancy, benefits, and your Energy Performance Certificate.

Contact an Approved Supplier: Engage with energy companies collaborating with the government.

Assessment: Suppliers will evaluate your boiler efficiency and home energy needs.

Approval and Installation: Eligible applicants will have their upgrades scheduled.

Direct communication with energy suppliers or official ECO4 support channels is advised as application processes may vary.

The LA Flex Scheme 2025, integral to the Energy Company Obligation (ECO4), underscores the shift towards low-carbon heating and enhancing household energy efficiency.

The LA Flex Scheme enables local authorities to nominate households that might not meet ECO4's national eligibility criteria for energy-saving measure installations, including boiler replacements and insulation. This scheme acknowledges the importance of heat pumps in transitioning away from fossil fuel heating.

The LA Flex Scheme extends to:

Residents in inefficient homes as identified by local authorities.

Households unable to improve energy efficiency without aid.

Eligibility is influenced by the household's current energy efficiency and income level.

To apply, follow these steps:

Contact your local authority for eligibility inquiries and express interest.

Provide required documentation as specified by the local authority.

Upon referral, an energy provider will evaluate the property to identify suitable energy-saving measures.

Approval processes and subsequent actions may differ across locations, reflecting each community's specific needs.

The Boiler Upgrade Scheme in 2025 offers grants for replacing old fossil fuel heating systems with greener alternatives like heat pumps and biomass boilers, aimed at increasing energy efficiency and reducing carbon footprints.

The scheme supports the installation of sustainable heating technologies, facilitating the shift to low-carbon heating by alleviating initial costs.

Grant Values: Grants of up to £7,500 are available for air and ground source heat pumps.

Exclusions: Hybrid systems that combine heat pumps and fossil fuel boilers are not eligible.

Installation Requirement: Only MCS-accredited installers can carry out the work to ensure quality and adherence to standards.

The scheme is open to:

Homes and non-domestic buildings in England and Wales with existing fossil fuel heating.

Installations must be completed by an MCS-accredited installer.

Confirm eligibility before installation to ensure compliance with scheme requirements.

Application Process

To apply, undertake the following:

Obtain installation quotes from MCS-accredited installers.

The installer submits the application on behalf of the applicant, registering the project with Ofgem.

Upon approval, the grant is paid directly to the installer, reducing the overall installation cost.

This streamlined application process is designed to ease the transition to greener heating solutions, contributing to reduced energy bills and supporting net-zero energy ambitions.

Boiler finance is available with iHeat, below is an example of how the prices work (guide only).

Brand | Interest rate (%) | Term (months) | Deposit | Price (£) | Interest payable (£) | Loan (£) | Payable (£) | Monthly |

Alpha | 12.9 | 120 | 50% | £1,965 | £724 | £985 | £2,689 | £14 |

Worcester | 12.9 | 120 | 50% | £2,295 | £848 | £1,155 | £3,143 | £17 |

Vaillant | 12.9 | 120 | 50% | £2,745 | £1,009 | £1,375 | £3,754 | £20 |

Ideal | 12.9 | 120 | 50% | £2,395 | £885 | £1,205 | £3,280 | £17 |

Last updated: 3rd February, 2026

Written by Stephen Day

Gas Safe Engineer at iHeat

Stephen Day is a Gas Safe registered and FGAS certified engineer with over 20 years of hands-on experience in the heating, cooling, and renewable energy industry, specialising in boiler installations, air conditioning, and heat pump systems.

LinkedInArticles by Stephen Day are reviewed by iHeat’s technical team to ensure accuracy and reliability.

27th February, 2026

Condensing boilers are considered to be some of the most efficient boilers out there on th...

Read Article

Read Article

26th February, 2026

Vaillant boilers use a variety of parts to ensure efficient operation. This section looks...

Read Article

Read Article

26th February, 2026

Leaving the heating on low all day might seem like a way to avoid the chill without bursti...

Read Article

Read Article

No obligation. Takes less than 60 seconds.